Gold! … and Other Inflation Hedges

The market environment of the past several years has underscored the need for investors to include inflation hedges in their portfolios. In this article, we’ll review the current investing landscape, take a quick tour through history to look for analogs and revisit the types of investments that perform well in these environments.

The Present Situation

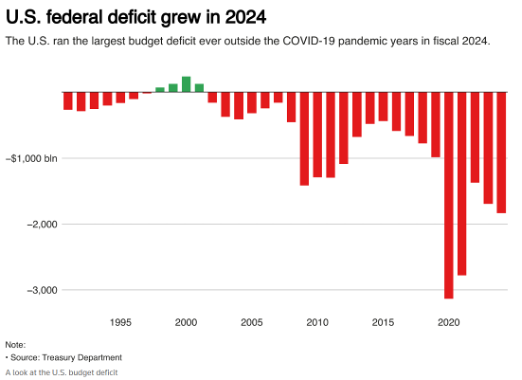

We are in a world that lacks fiscal austerity. To be more specific, we’ve never seen fiscal deficits like we are seeing in the post-COVID world (see chart below from REUTERS). COVID-19 justified record-breaking deficits worldwide, and politicians have since continued to maintain abnormally large deficits relative to historical precedent.

The net effect of large deficits is an ever expanding “National Debt” for the guilty parties and rising interest costs as a percentage of annual budgets. Two things jump out to us as being particularly noteworthy. For one, the United States is not alone in its lack of fiscal austerity. The issue is present in a host of other advanced economies as shown in the chart below from REUTERS. A second key observation is that these deficits are now occurring under both democratic and republican administrations worldwide.

Historical Analogs

A quick tour through the last 100 years informs us that there is likely only one solution to the current debt problem – inflation/currency devaluation. While some may suggest the solution lies in productivity gains from AI, it's difficult to find a historical precedent where productivity alone resolved a debt crisis. However, one can point to a main example of where inflation/currency devaluation was a primary remedy.

Specifically, let’s look at post WWII. It’s uncanny how similar the “debt-to-GDP” ratio looks to the current situation. Wars cause substantial federal spending and, for the U.S. and other nations, WWII pushed debt-to-GDP to then unprecedented levels.

So, we’ve been here before. No problem, right? Well one should pay close attention to how the federal debt was lowered as a percentage of GDP during that time. Specifically, the U.S. used “yield curve control” to manage debt costs while allowing inflation to run at above-average levels. While productivity gains certainly helped, they were, in our view, a less significant factor. For investors during this period, stocks and bonds underperformed their historical averages on a “real” (inflation-adjusted) basis, while various inflation hedges outperformed.

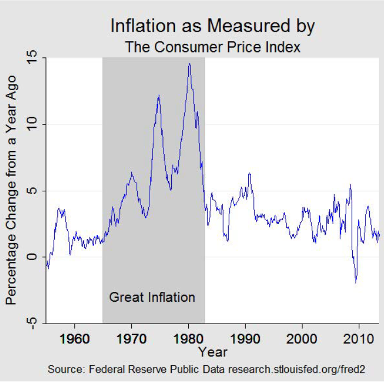

A similar (lack of fiscal austerity) moment came in the early 1970s. On August 15, 1971, President Nixon took the United States off the “gold standard.” The gold standard meant that U.S. citizens could redeem fiat currency (i.e., paper money) for a specified amount of gold. At the time, $35 U.S. dollars would get you one ounce of gold. The end of the gold standard contributed to a well-documented period of high inflation that lasted from 1965-1982, often referred to as the 'Great Inflation'. Like the post-WWII period, the top performing investments during this period were inflation hedges.

According to most economists, the Great Inflation was not a byproduct of the situation but rather it was necessary and by design (i.e., the U.S. needed to allow its currency to “float” given that its gold reserves were running low due to persistent trade deficits).

Déjà vu All Over Again

Well, persistent budget deficits have, once again, led us back to an environment that looks to be very pro-inflationary. It has taken the investing public a while to recognize the present situation, but the narrative appears to be gaining traction. For example, below is a chart comparing the gold ETF (GLD) to the traditional portfolio “anchors” (S&P 500 Index ETF (SPY) and an aggregate bond index (AGG)). Note that GLD has more than tripled SPY year-to-date and is around 10X the AGG return. (Data through 9/15/25)

Source: Yahoo Finance

Investing in miner stocks can often amplify the inflation-hedging benefits of precious metals. “Gold Miners” are, for example, the big beneficiaries of the move in gold and have already surpassed a 100% return for the year as measured by the GDX ETF (chart below). (Data through 9/15/25)

Source: Yahoo Finance

One nice feature of having inflation hedges in portfolios is that a little exposure can have a big impact. When these types of investment begin to move, the price changes can be extraordinary. This is true for precious metals, miners, commodities and various real assets. We’ve been using inflation hedges in certain portfolios and expect to continue to maintain some exposure as long as the environment remains supportive. We will also look to periodic rebalance as an opportunity to capitalize on any volatility. In our estimation, we may be in the early stages of the latest bout of inflation and currency devaluation as federal debts continue to grow worldwide.

This article is for informational and educational purposes only and does not constitute financial advice. The analysis presented here is based on publicly available data and represents a general perspective. All investment decisions should be made with the guidance of a qualified financial professional and based on a thorough understanding of your personal financial situation and risk tolerance. Past performance is not a guarantee of future results. Every investment involves risk and in volatile or uncertain market conditions, significant variations in the value or return on that investment may occur.