Tariffs - Sifting Through the Chaos

Back in February, we wrote an article about tariffs and possible impacts on portfolios as the United States was just beginning to roll them out. The tariff news feed feels like a roller-coaster ride with wild swings in announced tariff levels, changing implementation deadlines, and uncertain objectives. In this article, we’ll review the impacts since February, look at market performance, and discuss where we may be headed from here.

As a reminder, a tariff is essentially a fee charged by a country on goods or services that are imported. While tariffs do garner revenue for the government of the country that is the recipient of the imports, it is dubious whether tariffs benefit citizens. In fact, most economists would view tariffs as a form of “tax” that may either decrease corporate profit margins or increase consumer inflation (or both!). This generally accepted conclusion begs the question, “Why tariffs?” - a topic for another day but, in summary, many experts believe that the tariff policy is designed primarily to reduce the trade imbalance while generating some revenue.

Given the negative economic sentiments around tariffs, the market reacted unfavorably to a massive spike in announced tariffs during Q1 (see chart below). Here we see that the large “announced” tariffs triggered a sharp slide in the S&P 500 Index of 18.9% from February 19 through April 8. As the rhetoric receded and it was clear that announced tariffs appeared to be more of a negotiating strategy than reality, the market quickly rebounded (up 28.2% to a new all-time high as of July 28). One lesson here is to not overreact to news. The market tends to be “emotional,” and participants overreact in both directions, which is why there is value in rebalancing during these moments.

Source: Yahoo Finance

But what’s really happening here behind the scenes? Tariffs are not expected to be good for business, and tariffs have been increasing, so why did the stock market bounce back to new all-time highs? Count us in the camp of people who believe that the long-term effects of tariffs are still a big question mark. Look no further than the Federal Reserve Bank (the “Fed”) for affirmation. After announcing that there would be no change in the Federal Funds Rate (“FFR”) following the FOMC meeting on July 30th, Fed Chairman Jerome Powell said it quite succinctly: “The long-term effects of tariffs are unknown.” He also mentioned that they were just beginning to see some tariff-driven price increases. In fact, he justified the lack of movement in the FFR, in part, by highlighting the ongoing uncertainty created by tariffs (i.e., inflation may be heating back up).

The Federal Reserve Bank of Minneapolis offers additional analysis, noting a HUGE disconnect between the announced tariffs and the tariffs that are being realized by market participants. They offer the chart below which shows “Announced” tariffs at levels that are 2-3X higher than “Effective” tariffs. Again, this may be another example of why we have yet to see adverse consequences from degrading business performance.

The Federal Reserve Bank of Minneapolis (Neal Kashkari) provides some observations and conclusions that we re-print below (emphasis added in bold).

—————

Markets are remarkable in their ability to find paths around economic barriers, such as sanctions and tariffs, and this tends to increase over time. We have heard from some business contacts that they are rapidly adjusting their supply routes to find lower effective tariff paths. In addition, companies are bringing some goods into the U.S. under favorable terms of the U.S.-Mexico-Canada Agreement. And some sectors have been successful in seeking exemptions from tariffs, such as consumer electronics from China.

While the debate of whether tariffs will lead to a one-time increase in the price level or to a more persistent increase in inflation is important, we also must try to determine if that price level increase is merely delayed or is likely to be smaller than what was announced. This is challenging and will take time.

While we gather more evidence on the true tariff shock affecting the economy, I believe we should put more emphasis on the actual inflation and real economic data that we are seeing without committing to an easing policy path in case the effects of tariffs are merely delayed.

—————

For us, the conclusion here is twofold: (1) the Fed clearly thinks impacts will have a lagged effect as tariffs are finalized and businesses adjust, and (2) there is no debate as to whether tariffs are inflationary (i.e., they are!). The only debate is whether the impact is “one time” or “persistent.” Not great news for consumers or businesses.

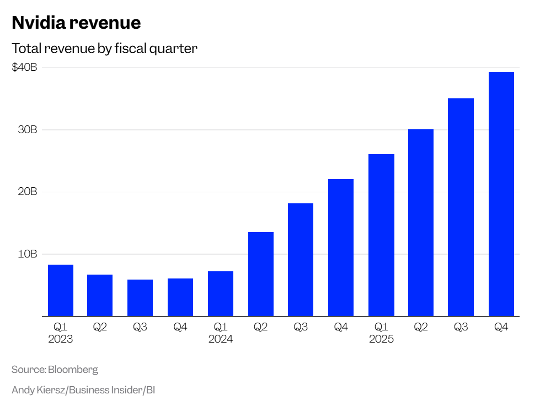

Another key factor muting the tariff effect is that the stock market has seen particularly strong earnings growth through all the rhetoric. Take NVIDIA as an example. With a price-to-earnings ratio above 60, it’s clearly an “expensive” stock, but this is one of the more remarkable growth stories we’ve ever seen (see chart below from Business Insider showing historical fiscal year growth). Other “mega caps” are also seeing solid 2025 growth. These mega cap tech growth stories are helping to overshadow tariff news.

So, where do we go from here? On the tariff front, we’re told by the current administration that we’re close to the finish line. To oversimplify the current situation, we now have a “baseline” 10% tariff on goods into the United States, a higher level "baseline" (i.e., 15%) for countries with which we have a trade deficit, and (even higher) customized tariffs for many countries based on a variety of country-specific factors, including ongoing negotiations.

Regarding long-term impacts, count us in the same camp as the Fed – results are likely to be lagged and tough to predict but adverse to businesses & consumers. The significance of the adverse impact will depend on the final tariff level and on companies’ ability to adjust (i.e., evade the tariffs and restructure supply lines). Regarding the stock market performance, as usual, short-term fluctuations are tough to predict as they’re almost always emotionally driven. We know that, in the long run, it’s primarily earnings that matter so the ability of AI to increase productivity and profit margins will be, in our view, a much more significant factor than tariffs in determining long-term market performance.