Inflation and the Forgotten Sectors

We’ve been proponents of adding inflation hedges to portfolios for some time. As highlighted in our recent article on gold, many of these pro-inflation investments have produced excellent returns. In this article, we’ll review why we think we may be in a new era of above-average inflation and which U.S. equity sectors may benefit.

The U.S. Federal Reserve Bank “Mandate”

Why is positive inflation a pretty good bet? For one, it’s noteworthy that the U.S. Federal Reserve Bank (the “Fed”), along with many other central banks, currently targets a positive 2% annual rate of inflation. And we’ve all heard “Don’t fight the Fed” – meaning one should construct investment portfolios that are consistent with Fed objectives. Targeting a 2% inflation rate was not always the case – it’s a modern era phenomenon that is considered a “mandate” and one of the Fed’s two primary objectives (the other being “full employment”). Part of the reason that central banks landed on a positive “target rate” of inflation is that broad deflation is so dangerous for economies. In a nutshell, deflation is scary because consistently falling prices can cause an economy to stagnate as consumer and commercial buyers delay purchasing decisions. So, the Fed works hard to avoid it.

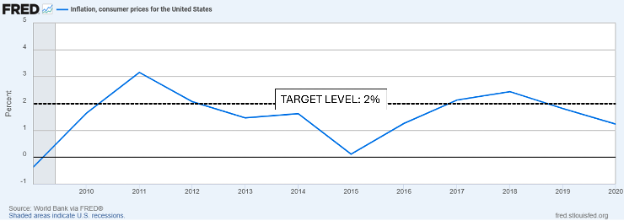

Despite the Fed’s inflation mandate, they generally failed to achieve the target rate in the decade following the Great Financial Crisis (“GFC”) – see chart below.

Inflation is a tricky thing for economists (and the Fed!) to forecast. In summary, we know certain activities are inflationary while others are deflationary but trying to build a model to predict exact levels of inflation has always foiled experts. The post-GFC period was initially predicted to be highly inflationary on account of the zero percent interest rate policy (“ZIRP”) and other “loose” Fed policy decisions. The reason that it never materialized is a topic for another day, but what matters for investors now is what happened post COVID.

COVID and the Era of Fiscal Dominance

COVID marked a dramatic turning point for federal government “fiscal policy” (i.e., policy decisions affecting U.S. budget revenue & expenses). More specifically, COVID led to unprecedented annual government budget deficits along with unprecedented levels of government spending going, in many cases, directly into the pockets of consumers and businesses. The combination of these two activities is deemed highly inflationary by economists and, in fact, contributed to substantial inflation. To understand the scale of this activity, consider that the U.S. Federal government has had a cumulative budget deficit of over $12.5 trillion dollars since COVID which is approximately 1/3 of the current Federal Debt. So, put another way, 1/3 of the Federal Debt was accumulated in just the last 5 years. Wow! Some have termed this a new era of “Fiscal Dominance” where government spending decisions are overshadowing other economic drivers (including Fed monetary decisions).

Most economists agree that these levels of government spending, barring a significant recession, will keep inflation running “hot” (i.e., above the 2% target). The data, in fact, supports this thesis. Below we repeat the inflation chart from above but with the post COVID data included. Here we see inflation, post COVID, ramping to 8%, and then retreating downward but landing more in the ~3% range – a full 1 percentage point above the Fed target rate. The future direction is, of course, unknown but count us as skeptical that 2% will be achieved in the near term.

Lessons from History

We care about inflation because it is a material factor in driving investment portfolio performance. We know that excess dollars into an economy can often land in risk assets which can push security prices higher. Clearly, the post-COVID fiscal activity has been beneficial to the U.S. equity market in this way (e.g., the S&P 500 Index is up around 200% from the COVID lows to the end of October 2025) – an annual return well above historical averages.

A review of history, however, uncovers very mixed U.S. equity market results during periods of persistent high inflation. Let’s review our last major inflationary period (i.e., from 1965-1985). As shown in the chart below, the U.S. spent nearly this entire period WELL ABOVE the Fed’s current 2% inflation target.

So, what can we learn from this period? One complicating factor of using this period as an analog to the present is that the economy was struggling during much of the period (i.e., unlike today it was “stagflationary” with HIGH inflation and LOW economic growth). In any case, we believe some lessons can be gleaned so let’s review what investments performed well during this period. Not surprisingly, the best performing asset classes were the traditional inflation hedges (e.g., gold skyrocketed from $35/oz in 1970 to over $800/oz by 1980). As expected, we also observe remarkable performance among a wide array of commodities.

When looking at the U.S. equity markets during the 1970’s, however, we find that the market appreciated on a “nominal basis” (i.e., the market went up) but on a “real” basis (i.e., net of inflation), the market lost value. Digging deeper we see that, during the 1970s, the top performing U.S. equity sectors were traditional “defensives” (e.g., Energy, Materials, Utilities, Healthcare, REITs, and Consumer Staples). Some high growth names such as the “Nifty 50” struggled as higher inflation and higher interest rates reduced the present value of future cash flows. In the case of the 1970’s the defensive names were somewhat buoyed by the rough economic times.

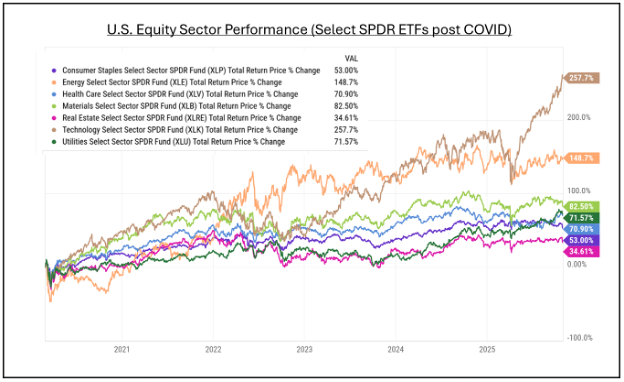

Bringing these lessons to the present, we see opportunity in periodically adding exposure to some of these sectors. This exposure can be achieved via tactical allocations to pro-inflation sectors or by using “equal weight” indices which rebalance more broadly. The good news for investors is that these sectors have largely been “forgotten” in recent years as money flowed into AI-related stocks. Given the overwhelming interest in technology stocks, these sectors have posted very muted returns following COVID. As the chart below shows, the SPDR Technology ETF (XLK) has dramatically outperformed each of these sectors. We see this divergence as opportunity based on how we manage portfolios.

Source: Yahoo Finance

In summary, it appears that we may be in an economic era that is highly impacted by fiscal activity and government spending. Barring a significant recession, economists see the current high levels of federal spending, and budget deficits, as inflationary. While predicting exact levels of inflation has proven nearly impossible, it’s likely that we will see some periods of above average inflation. Moreover, given that inflation affects equity sectors differently, we are likely to experience performance divergence as inflation forecasts change. We highlight that certain forgotten sectors have badly lagged the technology sector in the post COVID era which could lead to above average future performance. As usual, we hope to be able to capitalize on the volatility in sector performance through tactical allocations and periodic rebalancing.

This article is for informational and educational purposes only and does not constitute financial advice. The analysis presented here is based on publicly available data and represents a general perspective. All investment decisions should be made with the guidance of a qualified financial professional and based on a thorough understanding of your personal financial situation and risk tolerance. Past performance is not a guarantee of future results. Every investment involves risk and in volatile or uncertain market conditions, significant variations in the value or return on that investment may occur.